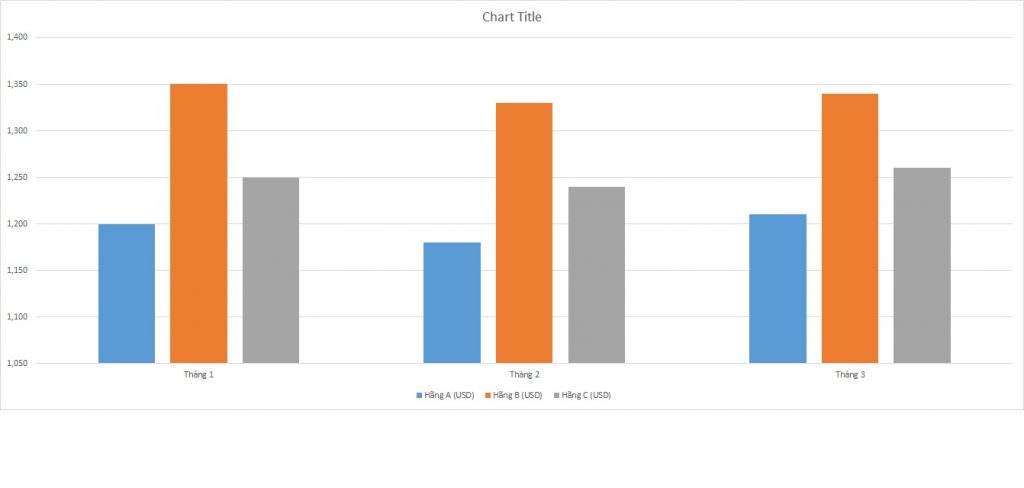

Bài viết IELTS Writing Task 1 yêu cầu bạn phân tích biểu đồ cột (Bar Chart) về chi phí bảo hiểm trong 3 tháng của 3 hãng ô tô khác nhau. Bạn sẽ cần mô tả sự khác biệt về chi phí giữa các hãng, xu hướng thay đổi theo thời gian và so sánh chúng để làm nổi bật những điểm chính và thông tin quan trọng.

Đọc bài này Cách làm bài IELTS Writing Task 1 Bar Chart trước khi làm bài.

Bạn cũng có thể đọc lại bài nói về Task 1 tại đây: IELTS Writing Task 1 cần lưu ý những gì?

Đọc thêm về xây dựng lộ trình học IELTS của The Real IELTS.

IELTS Writing Task 1 Bar Chart: Insurance Costs

You should spent about 20 mintutes on this task

In IELTS Writing Task 1, you are required to analyze a bar chart depicting insurance costs over three months for three different car brands. You will need to describe the differences in costs between the brands, observe trends over time, and compare them to highlight key points and important information.

You should write at least 150 words.

| Tháng | Hãng A (USD) | Hãng B (USD) | Hãng C (USD) |

| Tháng 1 | 1,200 | 1,350 | 1,250 |

| Tháng 2 | 1,180 | 1,330 | 1,240 |

| Tháng 3 | 1,210 | 1,340 | 1,260 |

IELTS Writing 1

Overview

The table presents a hypothetical comparison of insurance costs for three different car companies (A, B, and C) over a span of three months. The insurance costs are listed in US dollars for January, February, and March.

Body 1: Cost Analysis for Each Company

In January, Company A’s insurance cost is $1,200, Company B’s is $1,350, and Company C’s is $1,250. In February, the costs slightly decrease for all companies, with Company A at $1,180, Company B at $1,330, and Company C at $1,240. However, in March, the costs increase again: Company A rises to $1,210, Company B to $1,340, and Company C to $1,260. Overall, Company A consistently has the lowest insurance costs, while Company B has the highest across all three months.

Body 2: Monthly Trends and Comparisons

Examining the monthly trends, we notice that Company A shows a slight decrease from January to February, followed by a small increase in March. Similarly, Company B and Company C also experience a decrease in February and a subsequent increase in March. This trend suggests a general pattern of minor fluctuations in insurance costs across the three companies. Despite these fluctuations, the cost differences between the companies remain relatively consistent, with Company B always having the highest insurance costs and Company A maintaining the lowest, making it the most cost-effective option overall.

IELTS Writing 2

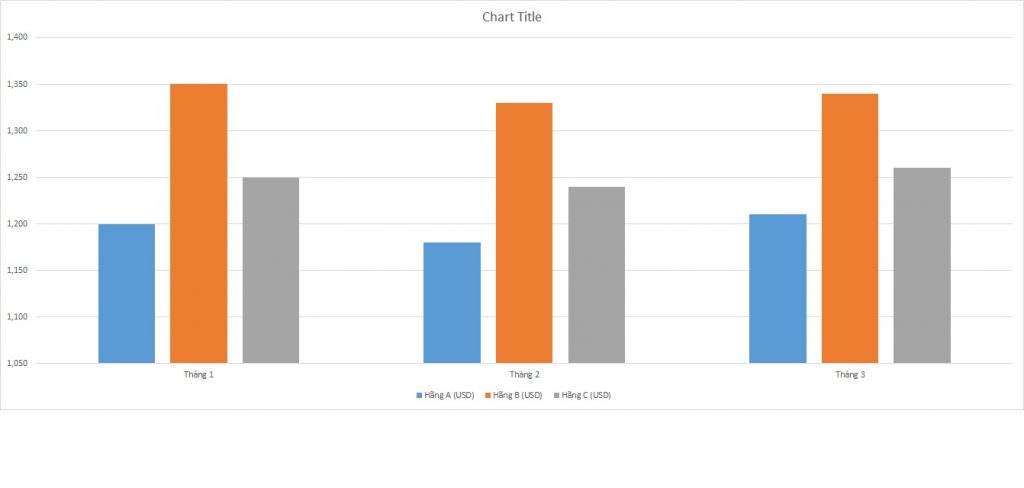

Overview

This analysis examines the insurance costs of three different car companies, A, B, and C, over a three-month period. The data provides insight into the trends and variations in insurance expenses, which can help consumers make informed decisions about their car insurance providers. By comparing the costs for January, February, and March, we can identify which company offers the most consistent and affordable rates.

Body 1

In January, Company A had an insurance cost of $1,200, which was the lowest among the three companies. Company B had the highest cost at $1,350, while Company C was in the middle with $1,250. This initial month shows that Company A is the most economical choice, followed by Company C and then Company B. The difference between the highest and lowest costs in January is $150, highlighting a significant variation in pricing.

Body 2

Moving to February, the insurance costs slightly decreased for all three companies. Company A’s cost dropped to $1,180, Company B’s to $1,330, and Company C’s to $1,240. Despite these reductions, the ranking remained the same: Company A offered the lowest cost, followed by Company C, and Company B remained the most expensive. In March, costs for Companies A and B increased to $1,210 and $1,340, respectively, while Company C’s cost rose to $1,260. Over the three months, Company A consistently had the lowest insurance costs, indicating it as the most cost-effective option.